Does Europe Prefer SAR Over USD

The relationship between currencies and their influence on global trade and finance is a subject of significant interest. One of the questions that often arises is: “Does Europe Prefer SAR Over USD?” This question involves examining various factors such as historical patterns, economic dependencies, geopolitical influences, and financial trends. In this article, we will explore these elements and provide a comprehensive analysis of the currency preferences in Europe, specifically when it comes to the Saudi Riyal (SAR) versus the US Dollar (USD).

The US Dollar’s Stronghold in the Global Economy

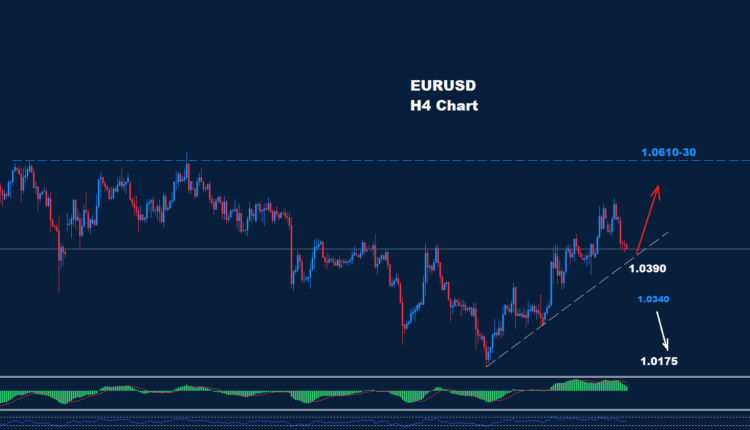

To understand currency preferences, it’s crucial to first acknowledge the dominant role of the US Dollar (USD) in global markets. For decades, the USD has been the primary reserve currency worldwide. This extensive use of the USD isn’t just limited to the United States but spans across international trade and finance. The reason behind the widespread use of USD can be attributed to its stability, liquidity, and the trust global markets place in the US economic system.

The US Dollar’s Role in Global Trade and Commodities

In global commodity markets, the USD continues to reign supreme. Critical commodities like oil, gold, and other precious metals are primarily priced and traded in USD. This means that even in Europe, businesses regularly interact with USD when settling trade deals. So, when asking “Does Europe Prefer SAR Over USD?” it’s clear that the US Dollar maintains an overwhelming presence in global commerce.

USD as the Reserve Currency of Choice

Additionally, the US Dollar serves as the world’s primary reserve currency. More than 60% of global reserves are held in USD, according to the International Monetary Fund (IMF). This figure underscores the US Dollar’s central role in global financial transactions. Even in Europe, multinational corporations and financial institutions often deal in USD, further solidifying its dominance in the global marketplace.

The Euro’s Position in Europe and Global Trade

While the US Dollar holds global dominance, the Euro (EUR) plays a critical role in Europe’s economic landscape. Launched in 1999, the Euro has become the second most traded currency globally. In the European Union (EU), the Euro is the official currency, used by 19 member countries. This gives the Euro a significant place in international trade and finance, but its role in the broader global economy remains secondary to the USD.

Stability and Strength of the Euro

The Euro is viewed as a stable and reliable currency due to the robust economies within the Eurozone. It has managed to maintain steady exchange rates against other major currencies, including the USD. Within Europe, the Euro is the go-to currency for intra-regional trade. However, when considering the question “Does Europe Prefer SAR Over USD?” it becomes evident that European businesses still predominantly rely on the US Dollar for global trade.

The Euro’s Limited Role in Global Transactions

While the Euro is the dominant currency for transactions within the EU, its influence in global trade is limited when compared to the USD. Many European countries, particularly those outside the Eurozone, still engage in trade and investments using the USD. This highlights that, even though the Euro is important in Europe, the US Dollar continues to be the currency of choice for many international dealings.

The Saudi Riyal (SAR): A Regional Currency with Limited Global Use

The Saudi Riyal (SAR) is the official currency of Saudi Arabia, and it plays a crucial role within the Middle East. However, its impact on global financial markets is much smaller. The SAR is pegged to the US Dollar, with an exchange rate of 3.75 SAR to 1 USD. This peg provides stability but also limits the currency’s movement in the international markets.

How the Peg to the USD Affects the SAR

The peg of the Saudi Riyal to the USD is a defining feature of its value. This fixed exchange rate means that the SAR moves in line with the US Dollar, which stabilizes its value but restricts its independence. The peg was introduced to stabilize Saudi Arabia’s economy, particularly due to the country’s heavy reliance on oil exports, which are priced in USD. As a result, this peg means that when discussing “Does Europe Prefer SAR Over USD?” the SAR is not a free-floating currency and has limited use outside the Middle East.

The Limited International Role of the SAR

Though Saudi Arabia is a major oil exporter, the SAR’s influence on the global financial stage remains minimal. European businesses engaged in trade with Saudi Arabia typically conduct transactions in USD rather than the Saudi Riyal. This underscores the fact that the SAR’s role is confined mainly to Saudi Arabia and the surrounding region, rather than the global economy.

Currency Preferences in Europe: The Role of the SAR

When it comes to Europe, the Saudi Riyal is rarely used as a primary currency for exchange or financial transactions. While European financial institutions may facilitate currency exchanges for the SAR, these are far less frequent compared to more widely used currencies like the Euro or USD. So, does Europe prefer SAR over USD? The answer is clear: the Riyal has limited acceptance in European financial markets, and the USD remains the dominant currency.

Currency Exchange and Investment in Europe

European banks and businesses involved in the Middle East may deal with the Saudi Riyal in specific contexts, but such exchanges are not widespread. Companies engaged in Saudi Arabia will often use USD due to its liquidity and acceptance in global markets. Even for investments in Saudi Arabia, European companies are more likely to interact with the USD rather than the SAR, further proving the USD’s global dominance.

Geopolitical and Economic Influences on Currency Preferences

The geopolitical relationships between Europe, the US, and Saudi Arabia also shape currency preferences. The US has long been an ally to many European nations, particularly in trade and defense. This longstanding partnership has cemented the role of the US Dollar as the preferred currency for financial transactions in Europe.

Oil Trade and the US Dollar

The global oil market also influences Europe’s currency preferences. Saudi Arabia, as a top oil exporter, conducts oil transactions predominantly in USD, which reinforces the Dollar’s importance in international trade. Although Saudi Arabia is diversifying its economy, the oil market remains a core area where the SAR is pegged to the USD, limiting the Riyal’s impact on global trade.

Future Outlook for the Saudi Riyal and the USD in Europe

Saudi Arabia’s Vision 2030, an initiative aimed at diversifying the country’s economy, may lead to changes in how the SAR is used. However, it’s unlikely that the Saudi Riyal will replace the US Dollar or Euro as the dominant currency for global trade anytime soon. Despite efforts to reduce oil dependence, the SAR is expected to remain a regional currency with limited global reach.

Key Facts about “Does Europe Prefer SAR Over USD?”:

- US Dollar Dominance in Europe:

The US Dollar (USD) remains the preferred currency for international trade and investment in Europe, even when dealing with Saudi Arabia. This is largely due to the Dollar’s global liquidity, stability, and widespread acceptance in financial markets.

- Saudi Riyal’s Limited Global Reach:

Despite being pegged to the US Dollar, the Saudi Riyal (SAR) has limited usage outside of Saudi Arabia and the Middle East. In Europe, the Riyal is not commonly used for international transactions, with USD being the primary currency for European businesses engaged in trade.

- The Role of the US Dollar in Commodities:

A major reason why “Does Europe Prefer SAR Over USD?” is a rhetorical question is the USD’s dominance in the pricing of commodities, particularly oil. Since oil and other key resources are traded in USD, Europe continues to rely heavily on the Dollar for its international business dealings.

- The Saudi Riyal’s Peg to the US Dollar:

The Saudi Riyal is pegged to the US Dollar at a fixed exchange rate of 3.75 SAR to 1 USD. While this peg provides stability for the Riyal, it limits its independence and ability to be used freely in global markets, further solidifying the USD’s role in Europe and worldwide.

- Geopolitical and Economic Factors:

Europe’s strong political and economic ties with the US, combined with the Euro’s internal dominance, ensure that the US Dollar is the most widely used currency for European international trade. The geopolitical relationship between the US and Europe has reinforced the Dollar’s position as the currency of choice, making it unlikely that the SAR will replace it in global trade.

Conclusion: Does Europe Prefer SAR Over USD?

To conclude, the question “Does Europe Prefer SAR Over USD?” can be answered with clarity. Europe does not prefer the Saudi Riyal over the US Dollar. While the SAR is significant in Saudi Arabia and the Middle East, its global influence is limited. The US Dollar continues to dominate as the preferred currency for international trade, reserves, and investments. Despite Saudi Arabia’s economic diversification, the SAR’s use outside of the Gulf region remains minimal. Therefore, Europe maintains a strong preference for the USD in global financial dealings, while the SAR remains largely confined to the regional sphere.

FAQs

Does Europe engage in trade using the Saudi Riyal (SAR)?

No, Europe predominantly uses the US Dollar (USD) for international trade, even when dealing with Saudi Arabia. Although transactions within Saudi Arabia might involve the Saudi Riyal (SAR), European companies typically rely on USD for cross-border business due to its global acceptance.

What makes the US Dollar more popular than the Saudi Riyal in Europe?

The US Dollar is the primary global reserve currency, offering unmatched liquidity, stability, and broad international recognition. Its pivotal role in global trade, particularly in commodities like oil, cements its status as the preferred choice for European businesses and beyond.

Is the Saudi Riyal (SAR) tied to the US Dollar?

Yes, the Saudi Riyal is pegged to the US Dollar, with a fixed exchange rate of 3.75 SAR to 1 USD. This arrangement ensures stability for the Riyal but limits its autonomy and global market influence.

Can businesses in Europe use SAR for transactions?

European businesses may conduct transactions in SAR when working directly in Saudi Arabia. However, for international trade, they generally opt for the US Dollar (USD) due to its widespread acceptance and superior liquidity.

Will the Saudi Riyal eventually replace the US Dollar or Euro in global markets?

It’s highly unlikely. Despite Saudi Arabia’s efforts to diversify its economy, the Saudi Riyal (SAR) is expected to remain a regional currency. The US Dollar and Euro will likely continue to dominate international trade and finance, with the SAR’s peg to the USD reinforcing this trend.

Keep an eye for more latest news & updates on The Washington Vibes!